Daytona Beach, FL -

Daytona Beach, FL - A new study shows that Daytona Beach ranks in one of the lowest percentiles when it comes to credit score ratings for residents.

That study from the financial website WalletHub ranks 2,572 cities nationwide based on their median credit score. And out of those 2,572 cities, Daytona Beach is locked in a six-way tie at 2,358th.

"A lot of cities that we think of as affluent are doing better, all up at the 90th percentile or over," says Jill Gonzalez with Wallethub. "Some cities that might be struggling might have lower income and higher debt levels would have lower credit scores."

According to Gonzalez, part of the reason Daytona Beach ranks as low as it does is due to a high debt-to-income ratio and how people use their credit.

Daytona Beach's median credit score sits at 641, which has it locked in a tie with cities in Alabama, Michigan, Texas and Georgia.

While Daytona Beach might sit low on the list, two Florida cities made the top of the list in the 99th percentile with Sun City Center sitting in the number two spot with a median score of 791 and The Villages sitting at the top at 806.

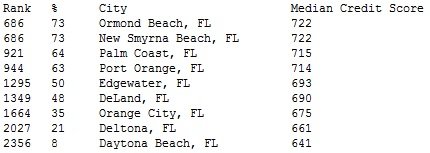

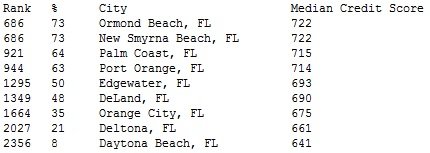

Here's how other cities in the Daytona Beach area ranked:

Even if someone has a lower credit score, Gonzalez says it's no reason to worry or fret as there are ways to fix it.

"The important thing to know here is that you're not really rushing against any clock," said Gonzalez. "This is something that you'll need to work at overtime. To see a pretty good boost of at least 20 points you'll need about six months."

Gonzalez says paying bills on time is the best and easiest way to repair credit and increase scores. Another way is to use around 30-40% of your credit, because "if you're staying between that margin and not maxing out your credit cards, that'll work wonders for your score."

She also mentioned that one common mistake some people make when repairing credit is when they "clean house" and close a lot of accounts. Gonzalez says one thing credit scores also depend on is the length of your credit history.

"Even if you're not using an account anymore, you want to keep it open because that actually boosts your score," said Gonzalez.

Opa-Locka sits the lowest out of all Florida cities, ranked in the bottom 1% with a median credit score of 589.

Daytona Beach, FL - A new study shows that Daytona Beach ranks in one of the lowest percentiles when it comes to credit score ratings for residents.

That study from the financial website WalletHub ranks 2,572 cities nationwide based on their median credit score. And out of those 2,572 cities, Daytona Beach is locked in a six-way tie at 2,358th.

"A lot of cities that we think of as affluent are doing better, all up at the 90th percentile or over," says Jill Gonzalez with Wallethub. "Some cities that might be struggling might have lower income and higher debt levels would have lower credit scores."

According to Gonzalez, part of the reason Daytona Beach ranks as low as it does is due to a high debt-to-income ratio and how people use their credit.

Daytona Beach's median credit score sits at 641, which has it locked in a tie with cities in Alabama, Michigan, Texas and Georgia.

Daytona Beach, FL - A new study shows that Daytona Beach ranks in one of the lowest percentiles when it comes to credit score ratings for residents.

That study from the financial website WalletHub ranks 2,572 cities nationwide based on their median credit score. And out of those 2,572 cities, Daytona Beach is locked in a six-way tie at 2,358th.

"A lot of cities that we think of as affluent are doing better, all up at the 90th percentile or over," says Jill Gonzalez with Wallethub. "Some cities that might be struggling might have lower income and higher debt levels would have lower credit scores."

According to Gonzalez, part of the reason Daytona Beach ranks as low as it does is due to a high debt-to-income ratio and how people use their credit.

Daytona Beach's median credit score sits at 641, which has it locked in a tie with cities in Alabama, Michigan, Texas and Georgia.

Even if someone has a lower credit score, Gonzalez says it's no reason to worry or fret as there are ways to fix it.

"The important thing to know here is that you're not really rushing against any clock," said Gonzalez. "This is something that you'll need to work at overtime. To see a pretty good boost of at least 20 points you'll need about six months."

Gonzalez says paying bills on time is the best and easiest way to repair credit and increase scores. Another way is to use around 30-40% of your credit, because "if you're staying between that margin and not maxing out your credit cards, that'll work wonders for your score."

She also mentioned that one common mistake some people make when repairing credit is when they "clean house" and close a lot of accounts. Gonzalez says one thing credit scores also depend on is the length of your credit history.

"Even if you're not using an account anymore, you want to keep it open because that actually boosts your score," said Gonzalez.

Opa-Locka sits the lowest out of all Florida cities, ranked in the bottom 1% with a median credit score of 589.

Even if someone has a lower credit score, Gonzalez says it's no reason to worry or fret as there are ways to fix it.

"The important thing to know here is that you're not really rushing against any clock," said Gonzalez. "This is something that you'll need to work at overtime. To see a pretty good boost of at least 20 points you'll need about six months."

Gonzalez says paying bills on time is the best and easiest way to repair credit and increase scores. Another way is to use around 30-40% of your credit, because "if you're staying between that margin and not maxing out your credit cards, that'll work wonders for your score."

She also mentioned that one common mistake some people make when repairing credit is when they "clean house" and close a lot of accounts. Gonzalez says one thing credit scores also depend on is the length of your credit history.

"Even if you're not using an account anymore, you want to keep it open because that actually boosts your score," said Gonzalez.

Opa-Locka sits the lowest out of all Florida cities, ranked in the bottom 1% with a median credit score of 589.