Daytona Beach, FL – Update: The Daytona Beach City Commission voted unanimously at Wednesday night's meeting to approve a $227 million budget and a 3% tax increase from the rolled-back property tax rate.

The new tax rate the Commission approved is $6.3333 per $1,000 of taxable property value. That's a 3% increase from the rolled-back rate of $6.1488 per $1,000. The 2016-2017 tax rate was 4.04% higher at $6.6367 per $1,000 of taxable property value, but property values in Daytona Beach have since increased. The new tax rate is scheduled to take effect on October 1 of this year.

"We've got a $2 million loss in revenue for the year and over $1 million in additional expenditures, and that's the reason why we think that a 3% increase over the roll-back rate is justified," says Budget Officer Fred Coulter. He told the Commission that the biggest reason for the increase is a more than $1 million increase in the cost for personal services like salaries and FICA.

Along with the tax rate, the Commission also approved a $227,189,319 budget for next year. This includes $170,665,403 for operating expenditures, $41,728,008 for transfers and $14,795,908 for project expenditures.

The budget also contains a 2% pay increase for all city employees on October 1, 2017. On April 1, 2018, there will be a 2% increase in pay for all active employees, where employees at the top of their pay range will take home a 1% lump sum payment. Other employees will be elevated to the maximum of their pay range and will receive the difference of that amount as well as a 1% lump sum payment.

Earlier Reporting:

The Daytona Beach City Commission will vote on the proposed 2017-2018 tax rate and budget during a public hearing at their Wednesday night meeting.

The tax rate that will be presented to the Commission is $6.3333 per $1,000 of taxable property value, a 3% increase from the rolled-back rate of $6.1488 per $1,000. The 2016-2017 tax rate was 4.04% higher at $6.6367 per $1,000 of taxable property value, but property values in Daytona Beach have since increased. The proposed rate of 6.3333% is expected to result in $26,211,475, or $4,138,676 of revenue per mill.

The new debt service millage rate is proposed as 0.3389 mills, a 9.2% decrease from the 2016-207 rate. According to a memo from the City Manager, James Chrisholm, this tax will pay for the debt service of General Obligation Bonds.

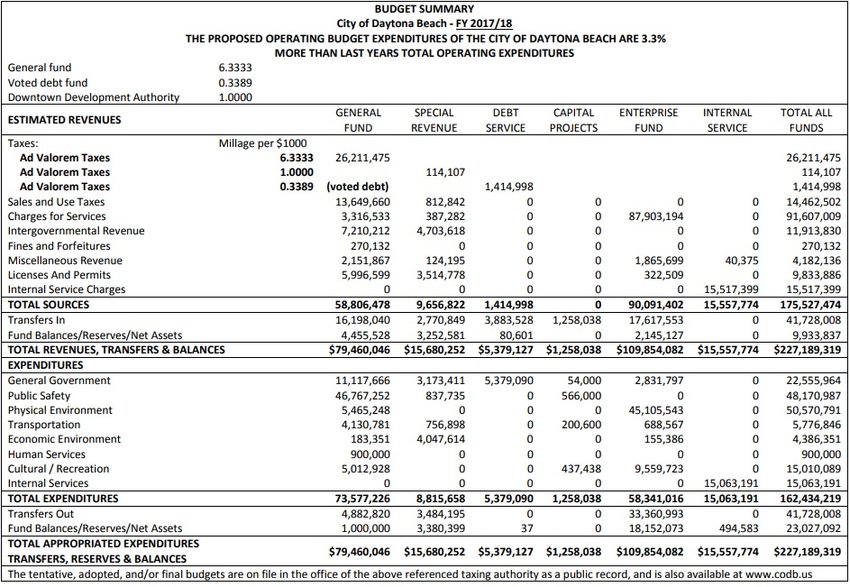

Here is a breakdown of the proposed 2017-2018 tax rate:

Daytona Beach, FL – Update: The Daytona Beach City Commission voted unanimously at Wednesday night's meeting to approve a $227 million budget and a 3% tax increase from the rolled-back property tax rate.

The new tax rate the Commission approved is $6.3333 per $1,000 of taxable property value. That's a 3% increase from the rolled-back rate of $6.1488 per $1,000. The 2016-2017 tax rate was 4.04% higher at $6.6367 per $1,000 of taxable property value, but property values in Daytona Beach have since increased. The new tax rate is scheduled to take effect on October 1 of this year.

"We've got a $2 million loss in revenue for the year and over $1 million in additional expenditures, and that's the reason why we think that a 3% increase over the roll-back rate is justified," says Budget Officer Fred Coulter. He told the Commission that the biggest reason for the increase is a more than $1 million increase in the cost for personal services like salaries and FICA.

Along with the tax rate, the Commission also approved a $227,189,319 budget for next year. This includes $170,665,403 for operating expenditures, $41,728,008 for transfers and $14,795,908 for project expenditures.

The budget also contains a 2% pay increase for all city employees on October 1, 2017. On April 1, 2018, there will be a 2% increase in pay for all active employees, where employees at the top of their pay range will take home a 1% lump sum payment. Other employees will be elevated to the maximum of their pay range and will receive the difference of that amount as well as a 1% lump sum payment.

Earlier Reporting:

The Daytona Beach City Commission will vote on the proposed 2017-2018 tax rate and budget during a public hearing at their Wednesday night meeting.

The tax rate that will be presented to the Commission is $6.3333 per $1,000 of taxable property value, a 3% increase from the rolled-back rate of $6.1488 per $1,000. The 2016-2017 tax rate was 4.04% higher at $6.6367 per $1,000 of taxable property value, but property values in Daytona Beach have since increased. The proposed rate of 6.3333% is expected to result in $26,211,475, or $4,138,676 of revenue per mill.

The new debt service millage rate is proposed as 0.3389 mills, a 9.2% decrease from the 2016-207 rate. According to a memo from the City Manager, James Chrisholm, this tax will pay for the debt service of General Obligation Bonds.

Here is a breakdown of the proposed 2017-2018 tax rate:

(Chart courtesy of Daytona Beach)

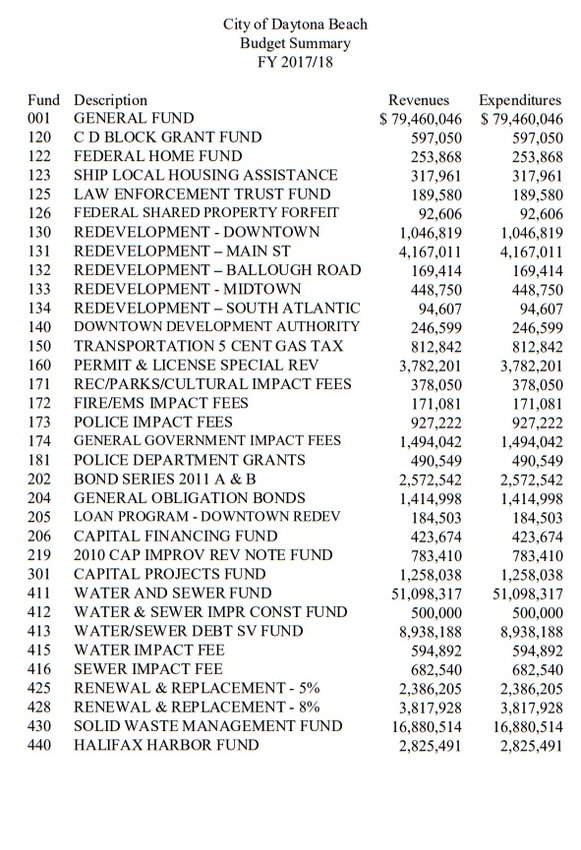

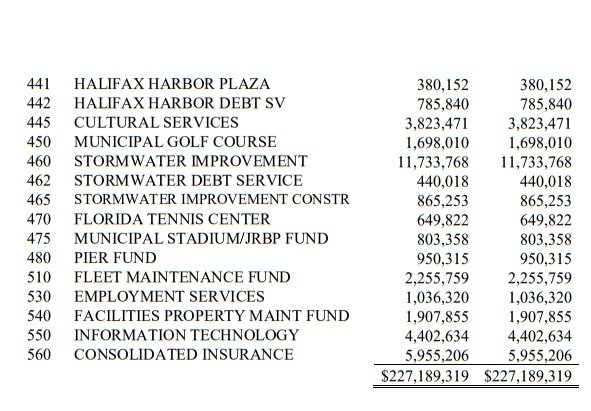

The Commission will also decide whether to approve a $227,189,319 budget for next year. This includes $170,665,403 for operating expenditures, $41,728,008 for transfers and $14,795,908 for project expenditures. The budget also contains a 2% pay increase for all city employees on October 1, 2017. On April 1, 2018, there will be a 2% increase in pay for all active employees, where employees at the top of their pay range will take home a 1% lump sum payment. Other employees will be elevated to the maximum of their pay range and will receive the difference of that amount as well as a 1% lump sum payment. Here is a breakdown of the proposed 2017-2018 budget:

(Chart courtesy of Daytona Beach)

Copyright Southern Stone Communications 2017.